If you are unexpectedly faced with a financial situation affecting your ability to make car payments, you may wonder what your options are. One option may be to return the car that you financed. However, there are some things you should know before you do that. If you financed your car purchase through the dealer, they might have specific rules about when you can and can’t return the car. You may have to pay a significant penalty to return the vehicle, which could impact your credit score.

Leasing agreements may include clauses for returning a vehicle early, though you may pay the penalty. Replacing a car you financed may negatively impact your credit score, so weigh all your options before deciding.

Can you return a financed car to the bank?

Yes, you can return the financed car to the bank or dealer when you can not afford it anymore, in the process of “voluntary repossession” or “voluntary surrender.” You can contact your lender or dealership and ask to return the financed car. However, the car lender will demand payment for the deficiency.

When you can no longer afford your car, you may consider returning it to the bank. This is called voluntary repossession or voluntary surrender. Contacting your lender or dealership and returning the car is simple. Remember that you may still be responsible for the remaining balance on the loan and any fees associated with the return of the vehicle.

Loan deficiency is the amount of money you still owe after you sell your collateral to help pay off your loan. The lender can sue you in court to obtain a judgment against you, called a deficiency judgment.

How do you return the financed car to the bank?

- Contact the Lender (the bank that holds your loan) directly.

- Speak with the Supervisor and start negotiating.

- Request Proof of the Transaction.

- If the lender accepts your offer, a lender or dealership will sell your car wholesale.

- You will need to make a demand payment for the deficiency.

- After the “voluntary surrender” process, your credit score will suffer because you have not repaid the debt as agreed.

Now I will share my opinion:

Usually, in my opinion, if you give your car back to the bank or dealer, you will lose more money than if you try to sell your car on your own. Usually, lenders will sell your car fast at wholesale price, and you must pay a high deficiency payment.

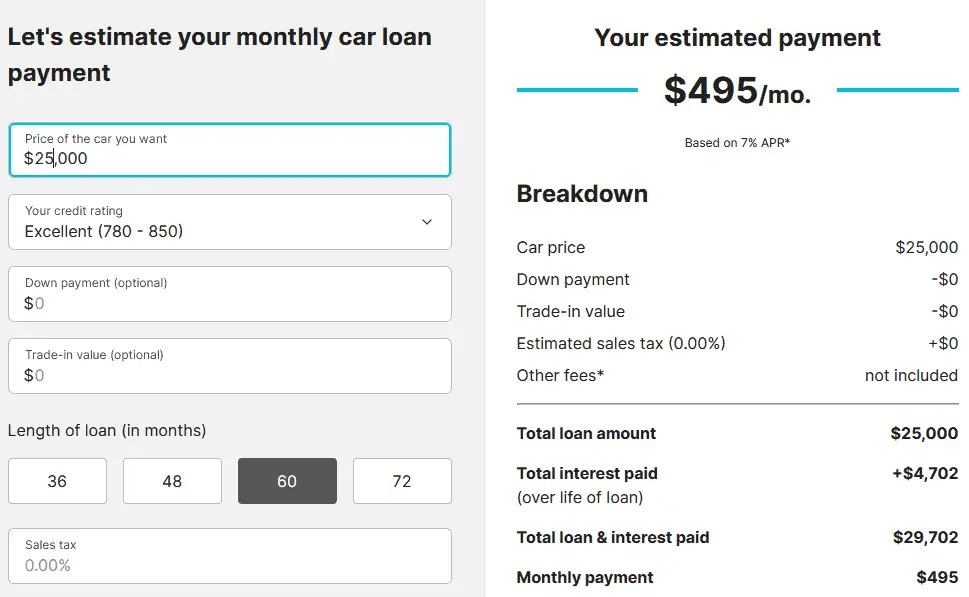

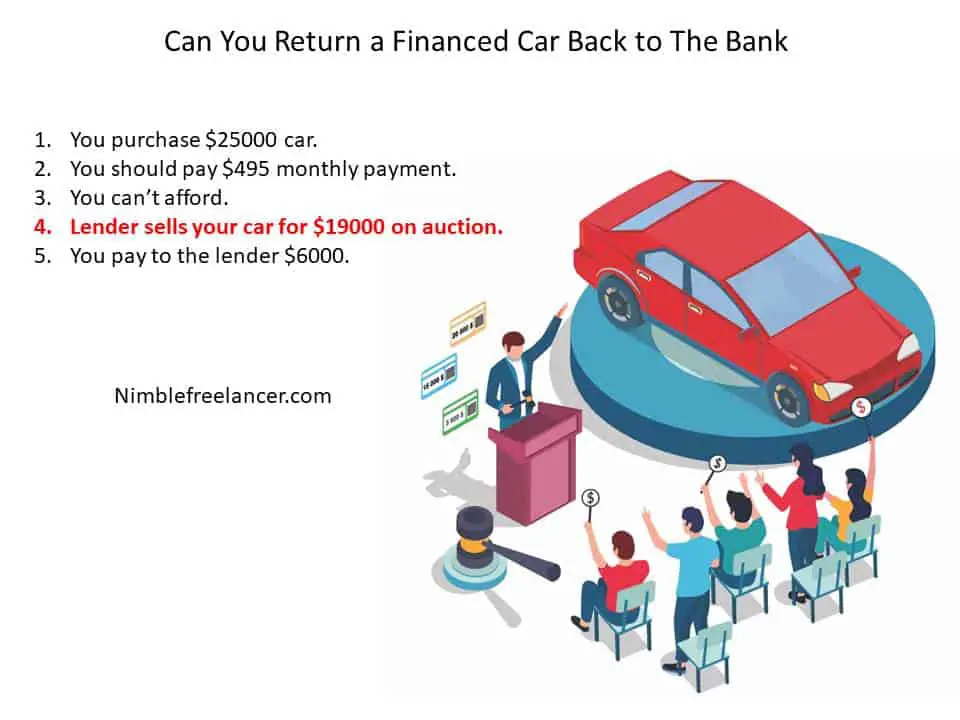

For example, you purchase a car worth $25000. You do not want to pay the loan anymore and want to return your vehicle to the bank. In that case, you, the lender, will sell your car for $19,000, and you will need to pay $6000.

Let us show this example in pictures:

Suppose you can not afford to pay a $495 monthly fee. You decide to back the car to the bank and pay the deficiency:

What can you do if you can not afford monthly car loan payments?

- The best solution is to sell the vehicle. If you can’t afford your car payments, sell the car. This will enable you to pay off the loan without damaging your credit score.

- Allow someone else (a friend) to take over payments. If your lender allows, you may be able to transfer your loan to someone else who will take possession of the vehicle and assume responsibility for the loan payments.

- Refinance the loan. If your current interest rate is high and your credit is good, refinancing your loan to one with a lower interest rate may be an option.

- Lease swapping is a great way to get into a car without spending much money. These websites, such as swapalease.com or Leasetrader, make it easy for you to find someone who wants to take over your lease, and they can be a great resource if you need a car for a short period. Remember that a fee is usually associated with using these websites, but it can be well worth it. The cost is between $90 to $400.

I am returning a financed car with damage.

You can not return a financed car with damage because it is covered by insurance. You need to fix it and then send it back to the lender.

When you return a damaged car financed, it’s essential to have your insurance information handy. The lender will likely need to file a claim with your insurance company to get the damages repaired. Depending on the severity of the damage, you may also be responsible for paying a deductible.

Sometimes, the lender may require you to return the car to them to have it fixed. If this is the case, they will typically cover the cost of the repairs. However, you will still be responsible for any damage that occurs while the car is in their possession.

If you’re returning a damaged car financed, ensure you understand your rights and responsibilities. If you have any questions or concerns, be sure to contact the lender.

The title loan value of my car

The title loan value of your car represents its worth as the current market price based on its model, age, location, and condition. You can use free online calculators such as Kelley Blue Book or Carfax to determine your car’s current price.

Any automobile sale would begin with obtaining a credible assessment of its worth. Two reliable sources for automotive appraisals are Kelly Blue Book and Cars.com. In reality, both companies should provide you with quotes. Give as much information regarding the object as possible to receive the most accurate valuation. Because this is the marketing approach you’ll be following, you will concentrate on “private function.”

They also offer “exchange” if you’d like to do it that route and “dealership retailing,” which isn’t applicable since you’re not an actual auto wholesaler. When valuing an automobile, a precise estimation of its value is critical, especially if it has a loan attached. The title is then signed by you and the borrower and given to the purchaser. Finally, the purchaser brings the approved title (with any other required documentation) to the county’s automobile administration to obtain new registrations and ownership.

With a title in possession, a private buyer can be relatively easy. You might be able to get an interest-free policy to build the total amount paid on the automobile if you already have good credit. The creditor will not be included on the property with an interest-free loan. The ownership will be delivered to you, and the vehicle will be ours. However, even if your reputation is excellent, unprotected bank loans carry higher interest than the most earned interest; pay it immediately after the purchaser’s cheque is deposited.

Then, you and a loan official sign the transfer and hand it over to the buyer, who will acquire a different moniker and registration. With excellent insurance, you can offset the shortfall with a conventional mortgage. However, payday loans seem more costly than most vehicle payments, so you’ll want to pay them off as soon as feasible.

A personal sale can be significantly more accessible with a title in possession. If you already have good credit, you might be able to get an overdraft facility policy to build the total amount outstanding on the vehicle. However, the borrower will still not be included on the property with an interest-free loan. The registration will instead be delivered to you, and the vehicle will be solely anyone else’s. Then, when another car is sold, you can pay off most of the debt.

Payoff balance car loan

Request the payback balance from the bank that owns your loan. (Worth noting: Because money occurs daily, this will fluctuate somewhat from the amount on your previous account.) After that, compare the loan sum to the car’s projected worth. This will inform you whether another vehicle is worth enough to complete the loan and let you stroll out the door with some income or if you’ll have to send a check to cover the mortgage when you return the shares.

This is a crucial component because if you evaluate that the reasonable sale cost of the vehicle wouldn’t be wrong to make a down reimbursement and give you free sufficiently cash for a home purchase on another car you would like to purchase goods, you would have to either find the funds or the vehicle will not even be sellable to be sold; however, you should be aware of this before rejecting a dealer’s offer. In addition, these may have a personal loan, which will, of course, complicate things. So, if the automobile is valuable enough to justify the sale, it will be more complicated than something else because the borrower controls the car’s official name.

Sale out your car at the bank that owns your loan

The most straightforward approach to managing the purchase of an automobile with a loan seems to be to conduct the transaction at the insurer’s official destination. You’ll be able to accumulate the money from the purchaser, pay off all the debt financing, and move the ownership to the current buyer. Conducting the sale just at the creditor provides various additional benefits. For starters, it serves as a neutral location for the purchase. One advantage is that it offers the purchase in a much more professional language than what is being conducted in your garage.

Finally, any documentation you may require from the borrower will be confident that the new. Next, the insurer’s employees may be able to create duplicates or notary stamps for any essential paperwork. This is the best option if your mortgage is from a local discount broker. Regrettably, most of those loans granted at vehicle showrooms work for large financial institutions like Chase and Capital One, as well as car companies’ lending departments Toyota Motor Credit, for illustration). It’s a little more complicated to purchase a car with such a monthly mortgage payment; however, it’s not prohibited.

The situation without state lenders

If the borrower isn’t in your area, you must take the driver’s commercial invoice to our government’s Department of Transportation. Then, you’ll need to get the purchaser an interim working permit. This will allow customers to access the automobile to the purchaser and give the seller a legal title after paying it off. However, you won’t have the ownership until another balance is paid off after completion because there will be a few weeks of waiting till that happens. You may be required to submit a charge to your lenders to speed up the title procedure, which can take weeks or months.

The possibility of this postponement will be a concern mainly for the customer, who will have an automobile even without the ability to drive it and the legal title. Nevertheless, unless you have the financial cash to pay off the car loan before the sale, there is no quicker method to finalize the transaction. Ask for supervision if you think you owe more on the mortgage than the automobile is worth. Propose that any shortfall on the car be reduced or waived in consideration of your willingness to make a payment. The shortfall is the discrepancy between loan debt and the car’s market value.

Especially if you give the automobile back freely, not all institutions will reduce a vehicle’s shortfall. Still, others will because they don’t want the inconvenience of ransacking and liquidating your car because that seizure does not entail employing an expert to recover the vehicle. As a result, the institution may make special arrangements for you, such as immediately decreasing your inflation rate or postponing repayments, to assist you. If you wanted to retain the car, your lender might be willing to make some compromises.

The company may grant you a monthly deferment and add any late payment to the conclusion of the repayment period. You might be able to postpone the borrowing for a week or three. You may be able to refinance your auto loan with the lender and decrease your expenses over a prolonged period. Good payment position; you might be able to pay it back at a cheaper interest income.

Can you return a financed car to the dealer after a year?

Yes, you can return a financed car to the dealer after a year only if the dealer or bank accepts “voluntary repossession.” In that case, you can give a lender to sell your car, and then you need to pay the deficiency. However, selling your vehicle or finding another person to take your lease is the best solution if you cannot afford monthly car payments.

When you lease or finance a car, you sign a contract that obligates you to pay for a specific period. This contract also usually dictates that the vehicle cannot be returned to the dealer until that period. If you want to return the car before that time, you may be able to do so, but it will likely come with some financial consequences.

If you have leased or financed your car and decide within the first year that you no longer want it, you have a few options. You can either trade the car for another one, pay off the remainder of what you owe on the vehicle, and keep it, or return the car to the dealer and pay the penalty.

The penalty for returning a financed car early is generally called a “buy-back.” The buy-back amount is based on the length of your contract and the amount of money you still owe on the car. For example, if you have two years left on your three-year contract and still owe $10,000 on the vehicle, the buy-back amount would be $2,000 (two years multiplied by $1,000).

If you are leasing a car, there may be penalties for returning it early. These penalties vary by leasing company, so it’s essential to read your lease agreement carefully. Some companies may require you to pay an extra fee for every month remaining on your lease, while others may require you to return the car in good condition and pay for any damages above and beyond normal wear and tear.

Conclusion

When you cannot make your car loan payments, you can do a few things to avoid negative consequences, like a damaged credit score or repossession.

You can sell the vehicle. This is the best option if you can’t afford to make your payments. It will enable you to pay off the loan without taking a hit on your credit score. Then, you can allow someone else (a friend) to take over payments. If your lender allows, you may be able to transfer your loan to someone else who will take possession of the vehicle and assume responsibility for the loan payments.

Finally, you can refinance the loan. If your current interest rate is high and your credit is good, refinancing your loan to one with a lower interest rate may be an option.

Please consider lease swapping as a great way to get into a car without spending much money. Websites such as swapalease.com or Leasetrader make it easy for you to find someone who wants to take over your lease, and they can be a great resource if you’re struggling to make your car payments.